Steal of the Century: Equifax Hacked

You can't imagine a more enticing target to hack than one of the three credit reporting agencies. As you have no doubt heard at this point, over 1/2 of America has had the "crown jewels" of their financial history stolen. This will be a story that will unfold over months not days as Congress is sure to haul executives up to the Hill for hearings to learn a few things from company executives including:

- Why did it take months for the company to let the public know about this hack?

- Why did the company executives sell stock immediately after finding out the hack (and before they notified the public)?

- Why did the company have such weak security on such important information?

We all know that credit reports and credit scores can be difficult topics to teach. Why not use this current event to have students research and complete a Scavenger Hunt that I created this evening?

But first, a few high quality resources that you students can use to complete the worksheet:

- Equifax Press Release

- PBS Newshour video (4:35): Did the Equifax hack put your personal data at risk?

- NY Times article: 4 things you should do about the Equifax hack

- Audio from NPR (3:06): Credit Reporting Agency Equifax Reveals Massive Hack

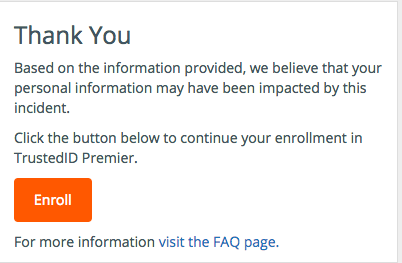

So, I wanted to see for myself, whether my information was safe. So, I went to www.equifaxsecurity2017.com, and based on the message below it looks like I am one of the 143 million. Now why would I want to click the button and enroll in their TrustedID Premier service (even if it is free)? As for me, my strategy going forward: Freeze my credit reports (which I had already done and blogged about almost three years ago after a series of high profile hacks), change passwords for some of my key financial accounts, and keep an eye on credit card and bank accounts for the foreseeable future.

--------------------

Be sure to teach your students about identity theft. Here's the NGPF lesson on Scams, Fraud and Identity Theft

About the Author

Tim Ranzetta

Tim's saving habits started at seven when a neighbor with a broken hip gave him a dog walking job. Her recovery, which took almost a year, resulted in Tim getting to know the bank tellers quite well (and accumulating a savings account balance of over $300!). His recent entrepreneurial adventures have included driving a shredding truck, analyzing executive compensation packages for Fortune 500 companies and helping families make better college financing decisions. After volunteering in 2010 to create and teach a personal finance program at Eastside College Prep in East Palo Alto, Tim saw firsthand the impact of an engaging and activity-based curriculum, which inspired him to start a new non-profit, Next Gen Personal Finance.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS