Curriculum Insider: Deep Dive Into The Middle School Investing Unit

Imagine middle schoolers talking to their parents about how compounding returns can be a tool to help build a brighter future together... or imagine 8th graders heading off to high school knowing how to start investing... or imagine high schoolers bringing a working knowledge of stocks and bonds into class on Day 1 so you can host rich discussions about diversification...

You're imagining students who have taken a personal finance course in middle school from a teacher using NGPF's Middle School course!

One of the most popular units in the course, Investing is the 6th of 9 Units in NGPF's Middle School Course. Through the course of the Unit, middle school students learn:

- Why investing is such an important component of our financial well-being [MS-6.1 Why Invest?]

- How the stock market is organized into sectors of publicly traded companies whose share prices rise and fall over time [MS-6.2 The Stock Market]

- The functional differences between investing in stocks, bonds, and mutual funds [MS-6.3 Stocks & Bonds]

- The importance of diversification between stocks, bonds, and index funds as a way to spread your investment risk across different asset classes [MS-6.4 Diversification]

- The time value of money, and how they can start investing earlier than most through custodial investment accounts [MS-6.5 How To Start Investing]

Today, we dive into each of the Middle School Investing Unit's lessons to spotlight resources that are particularly stellar from each. Read on below!

MS-6.1 Why Invest?

SPOTLIGHT ON INTRO - Would You Rather?

This simple scenario (which also requires almost no set-up) gets students to perform a meta-analysis of their own risk tolerance, opening dialogue about Investing's most central concept: risk. Every subtopic in the Investing unit ultimately spirals back to risk, so it's crucial to solidify students' a tactile opportunity at the very start of your Middle School Investing Unit.

MS-6.2 The Stock Market

SPOTLIGHT ON EDPUZZLE: Trends in the Stock Market

Visualizing market trends by their popular "mascots," as this charming video from It's A Money Thing illustrates, is a memorable introduction for younger students. In this EdPuzzle, students analyze the ways the stock market fluctuates in cycles, and how investors can profit in both bull and bear markets. This is not to be confused with an endorsement for day trading, though! Note the EdPuzzle's final question for a real discussion-starter about the reality of predicting trends!

MS-6.3 Stocks & Bonds

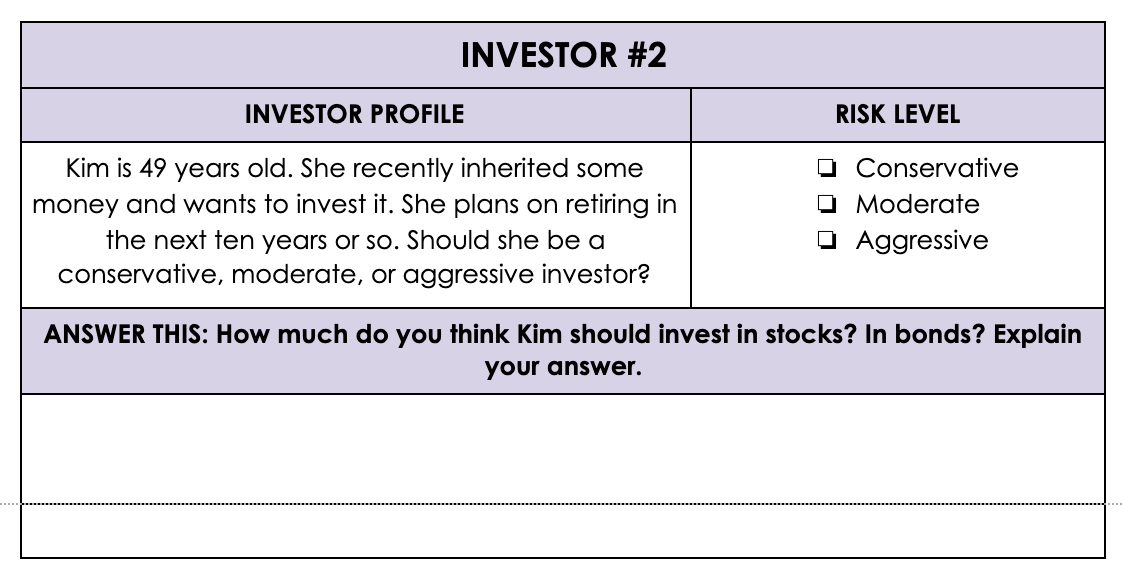

SPOTLIGHT ON COMPARE: Investment Portfolio Risk

In this cross-curricular exercise, students analyze the most pertinent investment strategies for several characters, all of whom are in different stages of their lives and have different goals. Students can then spiral back to their own risk tolerance.

MS-6.4 Diversification

SPOTLIGHT ON COMPARE: Stocks vs. Index Funds

Middle school students with a working knowledge of the value of low-cost index funds? That's a future we can look forward to! Using Yahoo Finance, this research activity uses commonly known companies like Nike and Amazon (and some others that haven't done so well recently, such as Xerox) to illustrate how individual stocks' performance can be very volatile. Meanwhile, the indexes they are part of still rise and fall in value, but less dramatically. Discussion: initiated!

MS-6.5 Start Investing

SPOTLIGHT ON VIDEO: How Two Sisters Grew a $16,000 Stock Portfolio By Age 11 & 13...

Students respond to EdPuzzle questions in this delightful story featuring two young people who invested in index funds in custodial accounts. Students can flex their newly acquired investing vocabulary, watch diversification in action, and relate to their near peers Sunoa and Melea. The sum total is an empowering exercise that shows middle school students that investing is possible whether you're 11 or 111 (a middle schooler's view of being 25).

We hope you enjoyed this deep dive into 5 resources from the 5 unique lessons in NGPF's Middle School Investing Unit. To explore full Middle School Units, Lesson Plans, and more, check out NGPF's FREE 9-Week Middle School Personal Finance Course and FREE Middle School Nearpod Collection!

About the Authors

Sonia Dalal

Sonia has always been passionate about instruction and improving students' learning experiences. She's come a long way since her days as a first grader, when she would "teach" music and read to her very attentive stuffed animals after school. Since then, she has taught students as a K-12 tutor, worked in several EdTech startups in the Bay Area, and completed her Ed.M in Education from the Harvard Graduate School of Education. She is passionate about bringing the high quality personal finance content and instruction she wished she'd received in school to the next generation of students and educators. When she isn't crafting lesson guides or working with teachers, Sonia loves to spend her time singing, being outdoors, and adventuring with family and friends!

Christian Sherrill

Former teacher, forever financial education nerd. As NGPF's Director of Teacher Success, Christian is laser-focused on helping the heroic teachers who fuel NGPF's mission to guarantee all students a life-changing personal finance course. Having paid down over $40k in student loans in the span of 3 years - while living in the Bay Area on an entry level teacher's salary - he's eager to help the next generation avoid financial pitfalls one semester at a time.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS