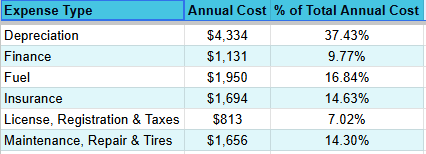

Question of the Day: What percent of the cost to drive a new car is the fuel cost?

High fuel prices can leave people feeling out of gas. Just how much do these purchases at the pump contribute to the cost of owning a car?

Answer: About 17%

- The largest cost element is depreciation. Why do you think that a new car depreciates (or loses value) over time?

- Changing the number of miles you drive will reduce your fuel cost. Will it change any of the other costs listed above?

- Insurance estimates are based on someone with 6 years of driving experience. Do you think the cost of insurance would be lower or higher for a teen just getting their license?

- The figures above are provided for a new car. What costs do you think would be lower if you drove a used car? What costs could be higher?

Click here for the ready-to-go slides for this Question of the Day that you can use in your classroom.

Behind the numbers (AAA):

- Depreciation: Based on the difference between new-vehicle purchase price & estimated trade-in value at the end of five years & 75,000 miles.

- Finance: Based on a 5-year loan, with 15% down, at the national average interest rate. Includes taxes & the first year’s license fees (national average).

- Fuel: Based on average prices for a 12-month period ending 5/25. During this time, regular grade gas averaged $3.151/gallon. Electric vehicle charging costs are based on a rate of 16.7 cents/kilowatt hour (an increase of nearly 1 cents/kWh).

- Insurance: Based on a full coverage policy for personal use of a vehicle by a driver who is under 65 years of age, has more than 6 years of driving experience, no accidents & lives in the suburbs or city.

- License, Registration and Taxes: Includes all government taxes & fees payable at time of purchase, as well as annual fees to keep the vehicle licensed & registered (national average).

- Maintenance, Repair and Tires: Includes retail parts & labor for routine maintenance specified by the vehicle manufacturer, a comprehensive extended warranty, repairs to wear-and-tear items that require service during 5 years of operation & one set of replacement tires.

---------------

Sharpen your students' budgeting skills with NGPF's Budgeting unit

About the Author

Dave Martin

Dave joins NGPF with 15 years of teaching experience in math and computer science. After joining the New York City Teaching Fellows program and earning a Master's degree in Education from Pace University, his teaching career has taken him to New York, New Jersey and a summer in the north of Ghana. Dave firmly believes that financial literacy is vital to creating well-rounded students that are prepared for a complex and highly competitive world. During what free time two young daughters will allow, Dave enjoys video games, Dungeons & Dragons, cooking, gardening, and taking naps.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS