Question of the Day: What is the lifetime value of a high school student getting financial education (in $)?

Kick off the school year with a strong motivator! With this dollar amount, you'll nip the question "when are we ever going to use this?" in the bud.

Answer: $100,000

Questions:

- Have you ever made a “money mistake” because you didn’t know something about finances? Explain.

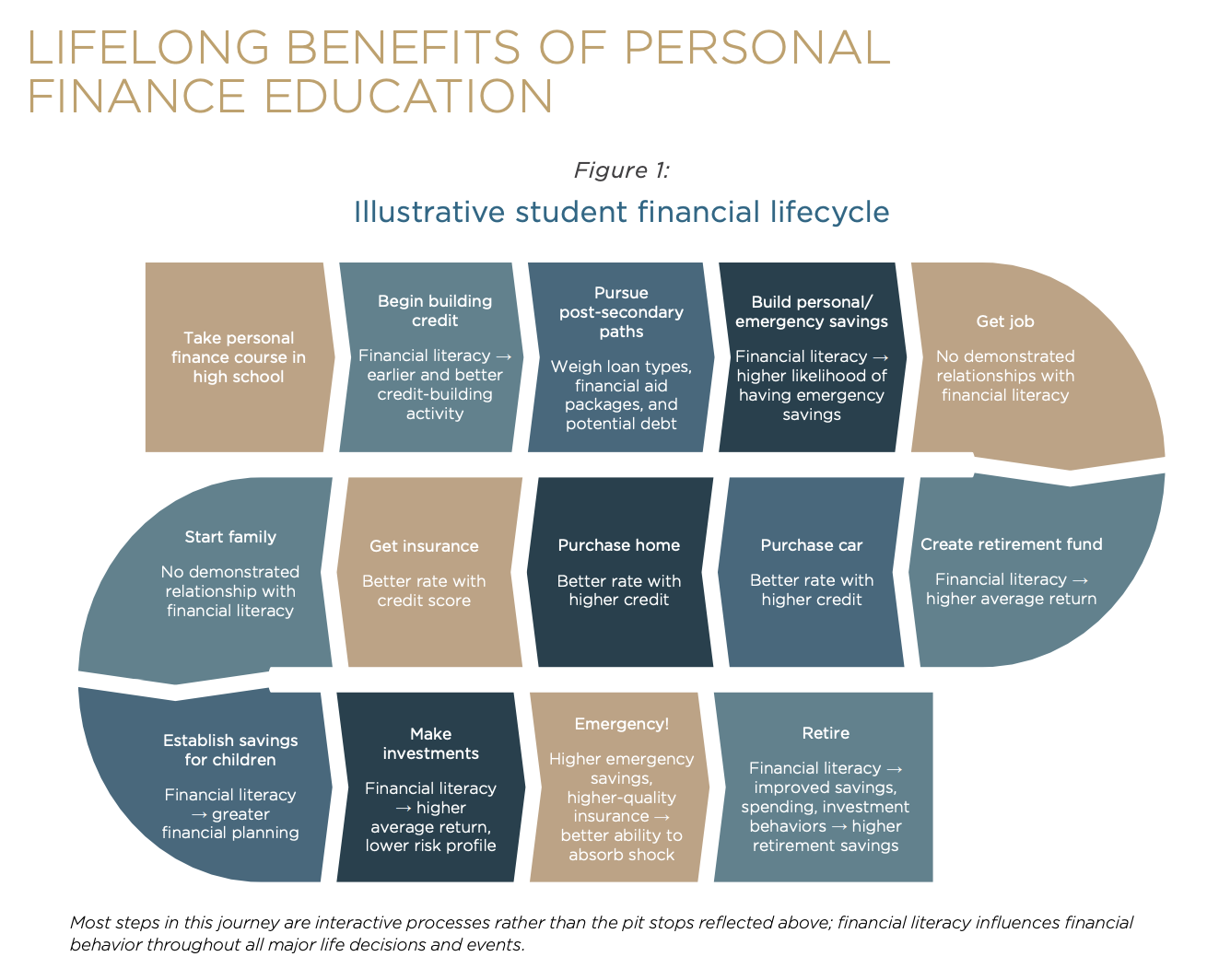

- How do you think financial education results in that lifetime benefit?

- When in life do you think financial education has the largest benefit?

Consider: college, early career, repaying debt, buying a house, investing, having a family, retirement, etc.

Here are the ready-to-go slides for this Question of the Day that you can use in your classroom.

Behind the numbers (Tyton Partners)

"While the potential benefits may be far more expansive, the studies included in our research are verified scholarly reports that demonstrate quantifiable benefits—in dollars— on financial outcomes. The benefits quantified in this research—which are likely not exhaustive of all potential personal finance education benefits—are as follows:

- Reduced credit/debt costs (i.e., interest savings on credit card debt due to better repayment habits and improved APR)

- Reduced student loan costs (i.e., greater consideration of debt in postsecondary decision-making, understanding of types of loans/funding available, and improved repayment rate)

- Reduced insurance costs (i.e., the cost savings of having a better insurance rate due to an improved credit score)

- Reduced borrowing costs (i.e., savings on home and auto loans due to purchasing/repayment behavior and an improved credit score’s influence on APRs)

- Larger retirement funds/assets (i.e., earlier retirement and/or financial planning’s impact on eventual wealth at retirement)"

About the Authors

Tim Ranzetta

Tim's saving habits started at seven when a neighbor with a broken hip gave him a dog walking job. Her recovery, which took almost a year, resulted in Tim getting to know the bank tellers quite well (and accumulating a savings account balance of over $300!). His recent entrepreneurial adventures have included driving a shredding truck, analyzing executive compensation packages for Fortune 500 companies and helping families make better college financing decisions. After volunteering in 2010 to create and teach a personal finance program at Eastside College Prep in East Palo Alto, Tim saw firsthand the impact of an engaging and activity-based curriculum, which inspired him to start a new non-profit, Next Gen Personal Finance.

Kathryn Dawson

Kathryn (she/her) is excited to join the NGPF team after 9 years of experience in education as a mentor, tutor, and special education teacher. She is a graduate of Cornell University with a degree in policy analysis and management and has a master's degree in education from Brooklyn College. Kathryn is looking forward to bringing her passion for accessibility and educational justice into curriculum design at NGPF. During her free time, Kathryn loves embarking on cooking projects, walking around her Seattle neighborhood with her dog, or lounging in a hammock with a book.

SEARCH FOR CONTENT

Subscribe to the blog

Join the more than 11,000 teachers who get the NGPF daily blog delivered to their inbox:

MOST POPULAR POSTS